The Private Venture(s)

|

Sincere Headway

is home to the GestaltRoni Project & Fund What is the GestaltRoni Project? The project is a project designed to eradicate poverty and create permanent employment for the average person in a city near you. Click HERE Send an email to invest office@sincereheadway.com

Navigate the LINK to donate to The GestaltRoni Project |

Find us on Social Media

|

|

|

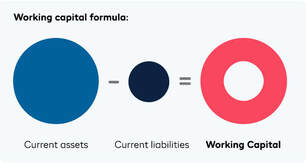

What is a WORKING CAPITAL LOAN? Working Capital Loans are loans that are taken out to finance the day-to-day operations of a business, rather than a financing option that is used to grow a business through acquisition or buy long-term assets. These loans cover short-term operational needs such as payroll, rent, and debt payments. Companies do not always have adequate cash on hand or asset liquidity to cover day-to-day operational expenses and thus, will secure a loan for this purpose. Companies that have high seasonality or cyclical sales usually rely on working capital loans to help with periods of reduced business activity. The immediate benefit of a working capital loan is that it's easy to obtain and lets business owners efficiently cover any gaps in working capital expenditures. The other noticeable benefit is that it is a form of debt financing and does not require an equity transaction, meaning that a business owner maintains full control of their company, even if the financing need is dire. Some working capital loans are unsecured. If this is the case, a company is not required to put down any collateral to secure the loan. However, only companies or business owners with a high credit rating are eligible for an unsecured loan. Businesses with little to no credit have to secularize the loan. A working capital loan that needs asset collateral can be a drawback to the loan process. However, there are other potential drawbacks to this type of working capital loan. Interest rates are high in order to compensate the lending institution for risk. Furthermore, working capital loans are often tied to a business owner's personal credit, and any missed payments or defaults will hurt his or her credit score. WORKING CAPITAL ADVANCES? A working capital advance, also known as a Merchant or Business Cash Advance, is not considered a loan. It is an advance of cash on your future credit card receivables, also referred to as a Revenue Generation Loan. For this reason, there is no APR rate and no set repayment terms. There is only a set payback amount. A flat fee will be charged to you for the advance. In most cases, these short-term working capital advances have a term of between three and twelve months. Why choose a WORKING CAPITAL ADVANCE? A working capital advance is ideal for a business owner who has had trouble obtaining funding from a traditional bank due to poor personal credit or lack of time in business. A working capital advance places less importance on these factors. However, they are deemed to be a high-risk advance and because of this the cost of capital will be higher. A working capital advance can be a great way to finance your holiday inventory, as chances are that you’ll need cash immediately, and working capital advances can get approved quickly. You don’t have to meet with a business manager and assemble all your business documents in triplicate—and you definitely don’t have to wait a month for the bank to get back to you about your approval. Repayments are made either daily or weekly via a business’ merchant processor or via a daily ACH debit from you company bank account. Working capital advances don’t affect your business credit limit, either. If an emergency happens, you can still turn to your credit cards or bank to find your way out of a struggle. These advances don’t cap your limit.  Why would you want a WORKING CAPITAL LOAN? A working capital loan can help when a company is in a squeeze and needs funding for short term goals. It costs less than a working capital advance, because more qualifications are required; a higher credit score, longer time in business and superior annual revenue. Such a loan also has more standard repayment plans and offers more flexibility compared to an advance. Working capital is the difference between your business’s current assets and liabilities. Assets may include accounts receivable, inventory, and cash on hand. Liabilities may include accounts payable and any payments on business debts due in the next 12 months. These short-term loans aren’t meant to solve all your problems. They are a stopgap to prevent the problem from getting any worse—and then allow you a pathway to working your way out of that debt.

0 Comments

Social dynamics is a term derived from the idea of the change in the behavior of an individual due the influence of those around him in a group. An important factor or combination of skill, communication is a two-way process that enables you to exchange your thoughts, notions, and opinions with each other. It is very important to realize the dynamics of social behavior within your surroundings and or setting and improve the way you communicate with different people. A. Verbal Communication Verbal communication skills are required daily. The way you talk is an insight into your skills and your personality. When your words are confident, it leaves a great impression on the other person. The skill of clarity in speech, careful selection of words, voice modulations, responsiveness, and considering your audience will impact your communication personally as well as professionally. It is also necessary to be able to articulate your thoughts, the primary way you express an opinion within social settings. B. Interpersonal Communication Interpersonal communication is another type that is essential in today’s world. Getting the right balance of verbal and non-verbal communication is paramount, no matter which setting you're in. On a personal level, it is essential to build relationships with your family or the significant other. And in your professional life, interpersonal communication is necessary to showcase your skills as a good employee and a good leader. i.e. you are in a meeting where you stare at your watch frequently. This signals the counterpart that you are less (not) interested and have something more important elsewhere. C. Visual Communication When it comes to communication mediums, visual communication is the strongest medium in our current era. i.e. a strong logo is a great way for a brand to communicate with its followers or clients. A great example of visual communication are pop-ups while playing a game, showing the necessity of visual communication within a successful marketing strategy in regards to any business. D. Listening Apart from the three main modes of communication, listening is also an important way of communicating. i.e. in an interview, if a candidate does not hear the question properly, he/she won’t be able to answer it thoroughly or well. Hence, developing listening skills is an essential aspect of improving your communication skills. E. Formal/Informal Communication When we talk about formal communication, it has a great impact on any organization/business. Reports, e-mails, proposals, etc., are used for formal communication and creates a professional work ethic. Informal communication, on the other hand, allows people to put forward their concerns, discuss problems or solutions or bounce around creative ideas. Communication done informally considers the feeling of others and thus, is a vital part of all social situations. Communication is an inescapable part of life, whether it is in a formal or an informal setting, in an office or at home. Navigating social dynamics requires a range of communication skills and ideas expressed above, making note of the terms and concepts mentioned, will help you understand how to communicate more effectively.

|

AuthorsFeed contains original content, company and network updates from visiting authors & the contributing staff of the private equity firm, Sincere Headway Archives

May 2023

Categories |

RSS Feed

RSS Feed