The Private Venture(s)

|

Sincere Headway

is home to the GestaltRoni Project & Fund What is the GestaltRoni Project? The project is a project designed to eradicate poverty and create permanent employment for the average person in a city near you. Click HERE Send an email to invest office@sincereheadway.com

Navigate the LINK to donate to The GestaltRoni Project |

Find us on Social Media

|

|

0 Comments

KineticCapitalMgt.com is currently "working" to provide American small businesses, with capital and loan type products. There are a number of product types to assist you in getting over a challenge or to seize an opportunity. Below find a downloadable PDF containing the K.C. Mgt one page application, for consideration.

Kinetic Capital Mgt offers a wide variety of Business Financing options. Did you know, one of them is Equipment Financing? If your business could benefit from purchasing new equipment to take on new clients, upgrade existing/outdated equipment or replace a broken piece of equipment, what are you waiting for? The time is now to take advantage of equipment financing! Equipment Financing can also provide tax benefits. Job highlights

Qualifications •Outgoing Personality •Be willing to go above and beyond •Efficient and effective communication skills Benefits •Team oriented individual •Schedule Flexibility •Exciting team environment •Growth opportunity in a rapidly growing company Full description Looking to combine work, fitness and fun? FNX is looking for energetic, enthusiastic people that are passionate about health and fitness to join our team. Working with FNX is more than a job, it’s an opportunity to inspire others to reach their fitness goals. Our of ‘Fuel for Greatness’ philosophy attracts a diverse and welcoming group of professionals and makes an amazing company to work with. FNX is now accepting applications for qualified Brand Ambassadors that are ready to be a part of a team and grow personally within an organization. What We Look for In Our Brand Ambassadors: • Create community excitement for fitness and well being • Promote the brand to local businesses • Willing to walk several miles per day to promote • Outgoing Personality • Organized • Service minded • Team oriented individual • Professional • Be willing to go above and beyond • Efficient and effective communication skills • Bilingual Spanish/English (preferred) The Ways You Benefit: • Schedule Flexibility • Exciting team environment groups Apply today for immediate consideration by sending an email to office@sincereheadway.com expressing how you can incorporate your lifestyle into this Brand Ambassador role and successfully engage people, activity and the products. An equal opportunity employer and does not discriminate against any employee or applicant for employment based on race, color, religion, national origin, age, gender, sex, ancestry, citizenship status, mental or physical disability, genetic information, sexual orientation, veteran status, or military status

How Bezos’s Amazon Legally Pays $0.00 in Taxes

The CEO Jeff Bezos is on the World’s Riches People’s List and is also one of the most notorious tax avoiders in American history.

2018 – Amazon more than doubled its profit, 2017: $5.6 Billion 2018: $11.16 Billion More importantly, Amazon got to pay $0 in taxes by using tax deduction, like you or I would; obviously much more lucrative deductions or decisions.

Here’s how Amazon did it in 2018:

Research and Development Tax Credit: 7% of what Amazon spent on wages and supplies for it R&D department, they get to claim as a deduction (thank you America for encouraging innovation). In 2018 Amazon saved more than $1.4 billion due to the tax credit. 2017: President Trump did his revision to the US tax code, specifically “Depreciation” that allow US companies to skip the decade long amortized process entirely to reap the benefits immediately, or from the very start i.e. Amazon builds a new data center it gets to claim the full tax deduction now instead of spreading it out over 30 to 40 years (tax code is to last at least until 2022). Look at the impact (Amazon’s deprecation) increased by 40% (not sure how much the tax revision affected the numbers): 2017: $8.8 Billion 2018: $12.1 Billion Stock-Based Compensation: Senior employees are paid in stock (options) rather than just cash. So Amazon gets to deduct the value of the money it gave. However in Amazon’s case, it didn’t buy the shares off the market and give to the employees, it just creates them, in the same way that the FED can print new money. The Amazon stock holders actually are who pay for it, because their shares are worth less because Amazon is constantly creating more to pay its employees; strategy works as long as the stock price keeps going up, as it did. This strategy not only made Amazon’s wages virtually free to the company, but also created a huge tax deduction. In 2018: Amazon saved $1 Billion by paying its employees in shares it created for FREE

Sincere Headway Inc.

Mike Ilitch was a minor league baseball player (four years), experienced a leg injury and was forced to quit baseball. He and his wife had saved up approximately $10,000 decided to open up a restaurant. He wanted to call it “Pizza Treat” and she wanted to call it, “Little Caesar’s,” so at the time they called it “Little Caesar’s Pizza Treat.”

I’ve personally, have chose it over a number of competitors all over the United States. Sincere Headway's Leadership Series WHY LAGOS (IN NIGERIA) IS (POTENTIALLY) AFRICA’S SILICON VALLEY

I am Curtis Christopher Wragg and this is nor the beginning nor the end of my story. “کریستوفر” I am the founder of Sincere Headway and as a commensurate business man, I bring the bread home, from work that I do on my social security number, contractually or you name it. Bottom line is its work, one way the gov't borrows money and you attempt to figure out how to get that money back verses the alternative, which is to work free from loaning monies to the government and you figure out a way to keep the money free from taxation, no surprises here this is the basics aye? The short of it, or reason I began jotting notes today, I agreed to contract in the future with a company that handled business today, per my merit or caliber and experience exposed in conversation, verses the company that is apparently focused on me contracting as staff in the months that come, concerned about the guards at the gates of a selectively preamble membrane of baggage, tentatively out of my control in regards to the red tape per se and|or bureaucracy, potentially awaiting papers to be pushed. To me this morning it just made sense, when you find what you want, sometimes you simply try and get as close to it as possible, maybe still at a distance, yet at least close enough in theory to respect the range of your predatory skills and attributes. In a world where we have enough problems, i.e. government reflecting our tallest microcosm, it was said prior to our current administration in office, "this might be the last structured team to take office, as we've witnessed the pervasive tide rolling in a state of nature." Being me to my point, are we working through this together, or do I (we) need to be perfect? Inquire for more information at office@sincereheadway.com Have you had the chance to check the programs below? Our founder and FasterCapital Regional Partner, Topher Wragg is interested to help. Providing 3 programs that cover all startups needs

1. Raise Capital 💰💵 https://fastercapital.com/raise-capital.html : for startups that are looking to raise capital from angel investors, VCs, incubators/accelerators (we help also in pitch deck/business plan, startup evaluation and term sheet). In this program there's an advance payment to cover 25% of our costs and a commission once money is raised. You can submit here: https://fastercapital.com/raise-capital/joinus.html?c=19901 2. Tech cofounder 🖥️📲 https://fastercapital.com/incubation.html : for startups that are looking for help in technical development per equity. We do the whole technical development from A to Z and invest 50% of the money needed per equity. Equity is negotiable and depends on our investment and valuation of the startup. You can submit here: https://fastercapital.com/technical-cofounder/joinus.html?c=19901 3. Grow your Startup 📈 https://fastercapital.com/grow-your-startup-program.html : for startups that are looking for business development, growth, expansions and sales/marketing. We provide business development per equity and trained staff who will work on your startup. Please fill the form here: https://fastercapital.com/grow-your-startup/joinus.html?c=19901 It won't take more than 5 minutes. 💡 If your startup is at an early stage, then you can join our idea to product program: https://fastercapital.com/idea-owner/joinus.html?c=19901 in the second and third program we invest ourselves but in work per equity and from usd 25k to 2m in the first program, we help you raise capital from external sources. We charge some small fee to cover some of our costs. It starts with usd 2000. We don't accept startups that are looking to raise below usd 100k The process begins by you submitting, then FC gathers info then FC will schedule the call and send you an offer.

Support The Economy The Fed on Wednesday committed to using its full capability to support the economic recovery. The central bank will continue buying Treasuries and mortgage-backed securities, as it has “at least at the current pace to sustain smooth market functioning.” A separate statement on Wednesday noted those figures at $80 billion of Treasuries a month and $40 billion of mortgage-backed securities. Officials see rates remaining very low through 2023, according to the median projection of their quarterly forecasts, though four officials penciled in at least one hike in 2023.

The Path Ahead “The recovery has progressed more quickly than generally expected,” Powell said, while cautioning that the pace of activity will likely slow and “the path ahead remains highly uncertain.” In addition to cutting borrowing costs in March, the central bank has pumped trillions of dollars into the financial system through bond purchases and launched a number of emergency lending facilities to keep businesses afloat (reference the “CARES Act” or the “Act”). The economy has partly recovered from the steepest downturn on record and some sectors such as housing are doing well, but Covid-19 continues to kill thousands of Americans each week, unemployment remains high and industries like hospitality and travel are depressed. An exert from a larger article/publication. Article Link We are pleased to connect you to our partner website, where resources are used to help startups launch. The site provides, education and tools to walk aspiring Founders through the entire startup process: including education, business planning, mentorship, customer acquisition, funding, and staffing. Navigate the link below or click the image, to find an over-caffeinated team of 170 startup nerds dedicated to helping over a million Founders like you pursue their passion.

Dear Contemporaries—Introducing the latest private venture, Sincere Headway is happy to bring our relationship with FNX Fitness to the surface. A fitness company committed to creating innovative supplements of the highest quality that provide focus for a productive morning, energy to thrive all day, performance supplements to reach new goals, unique sleep and recovery formulas to support any sport, and healthy supplements to support an active lifestyle for years to come. TOGETHER WE RISE FNX sponsors several athletes—as part of our network of friends and associates use the code “ShopHead1st” at checkout to represent and receive a discount as well. On top of that every purchase made on the web, a child in need receives one gallon of clean water thanks to the partners. Last inquiry, the donation of over 103,825 gallons of clean water—be apart of the LiVE program with us.

On March 27, 2020, President Trump signed an extensive $2 trillion piece of legislation called the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act” or the “Act”). This legislation addresses the severe impact of the coronavirus (COVID-19) pandemic. The legislation provides specified conditions for:

- Loans and assistance to companies and state and local governments - Low-interest and small business loans that can be partially forgiven - Payments to individual taxpayers - Additional unemployment benefits - Suspension of certain federal student loan payments - Financial hardship forbearance on federally backed mortgage loans - Assistance to hospitals and veterans care - Funding for national stockpile of pharmaceutical and medical supplies - Tax relief provisions. Individual Provisions Individual Rebate Checks The Act provides recovery credits for eligible individuals of up to $1,200 for single filers (and up to $2,400 for joint filers), plus a $500 credit per qualifying child. Rebates are subject to phase-out thresholds beginning at $75,000 of adjusted gross income (“AGI”) for single filers/$150,000 for joint filers. Rebates are not available for single filers with AGI over $99,000 and over $198,000 for joint filers. AGI is generally based on 2019 return information (or 2018 information if a 2019 return has not yet been filed). Retirement Plan Waivers The Act waives the 10% early withdrawal penalty tax (under IRC Sec. 72(t)) on early withdrawals up to $100,000 from a retirement plan or IRA for an individual who is diagnosed with COVID-19; whose spouse or dependent is diagnosed with COVID-19; who experiences adverse financial consequences as a result of being quarantined, furloughed, laid off, having work hours reduced, being unable to work due to lack of child care due to COVID-19, closing or reducing hours of a business owned or operated by the individual due to COVID-19; or other factors as determined by the Treasury Secretary. Business Provisions Paycheck Protection Program Loans To help small businesses and their employees, the Act provides loans to small businesses. These loans apply to any business that employs less than 500 employees or, if applicable, the amount set by the Small Business Administration for the business industry. For these loans, the definition of small business includes sole proprietorships and independent contractors. The maximum loan amount is 2.5 times the average monthly payroll costs incurred in the previous year ending on the date of the loan or $10 million. Employee Retention Credit The Act provides a refundable payroll tax credit for 50% of “qualified wages” paid or incurred by eligible employers to employees after March 12, 2020 and before January 1, 2021. The credit can be claimed on a quarterly basis. The credit is available to employers carrying on a trade or business during calendar year 2020 and whose (i) operations are fully or partially suspended due to a COVID-19 related shutdown order or (ii) gross receipts decline more than 50% as compared to the same calendar quarter in the prior year. Tax-exempt organizations are eligible where their operations are fully or partially suspended due to COVID-19. Delay of Payment of Employer Payroll Taxes Employers and self-employed individuals are allowed to defer payment of Social Security (Old Age, Survivors, and Disability Insurance) taxes for the period from the date of enactment of the Act through December 31, 2020. All of the employer portion of the Social Security tax and 50% of such taxes incurred by self-employed persons qualify for the deferral. Half of the deferred tax is to be paid by December 31, 2021; the other half is to be paid by December 31, 2022. Net Operating Losses Under the Act, a net operating loss (“NOL”) arising in a tax year beginning in 2018, 2019 or 2020 can be carried back for five years. It also allows for NOLs arising before January 1, 2021 to fully offset income. It is important to note that many of the provisions of the Act may require the filing of additional forms to amend previously filed tax returns and individuals and businesses will still need to take state and local tax considerations into account. Contact jason@bovellfinancial or (212) 332-1660 for questions about the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). Any questions otherwise contact cwragg@sincereheadway.com before I take off. The US Senate published a terrific resource outlining the various relief programs available to U.S. Small Businesses. Best summary they say to date. #read

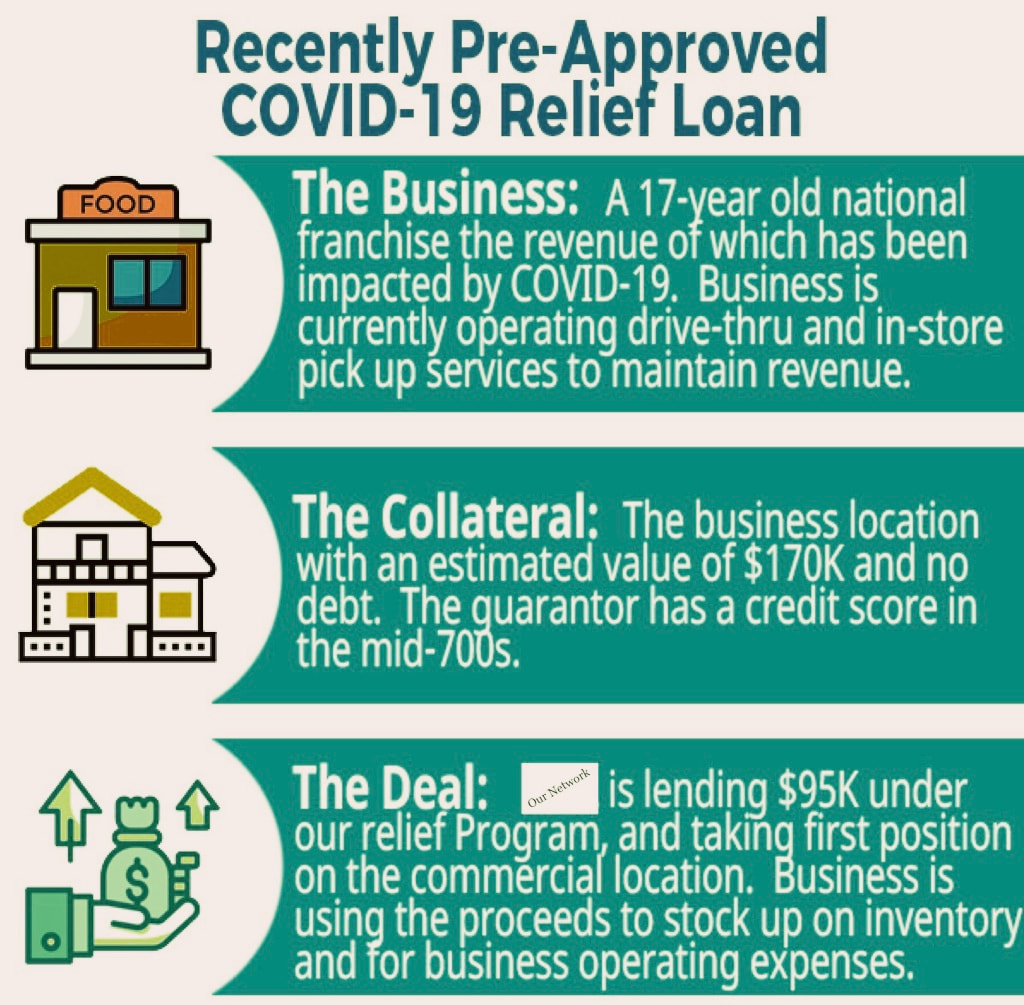

Recently Pre-Approved COVID-19 Relief Loan Loan structure is designed to limit payments for businesses with little to no cash flow as a result of the pandemic.

Contact Kinetic Cap Mgt

Email kineticcapitalmgt@gmail.com LESSON ON CONSISTENCY For years, my friend’s wife would buy him a particular fragrance of Gucci cologne. It was accompanied by the adjacent body wash etc. This sets the platform to discuss my lesson on consistency. How often have you heard someone announce, “be (more) consistent”? Over my time, that phrase has anchored so many dialogues, I refuse to count or recall. In my case, I personally have the ex-girl friend who in most times of crisis she would interject, “you need to be more consistent,” and for extended periods of time I genuinely tried to link the concept to the current debatable situation. Which to this day has shaped my ideology in regards to the concept of being consistent. Think with me, consistently right or wrong or in the details, we make a choice to do things a certain way either with or without perfect knowledge of our choice being the best or even right. Contrary I reference my friend’s situation involving cologne. Beyond my cheap Gucci plug in reference to its old classic scent and formula, my friend consistently bathed and groomed himself, which was the prerequisite to applying the scent or balm to areas of his body; after years of repeating this sequence, it perfectly illustrates “consistency” for me. Over the years, my friend’s body began to not only take on the scent, but it began to manifest an odor of the same or adjacent to it. In summary, over time, whether he applied the Gucci brand products or not, my friend’s body produced a similar scent to that of Gucci. Verified by the women who made the majority of the purchases, while they dated and even to this point now as married people to each other years ago. Accordingly note the residual effect of buying and applying something that after making decisions to repeat over and over again, becomes part of your person, both with as well as without the product you once purchased as a primary catalyst. Seemingly a great exercise of consistency, verses consistently doing something over and over again and finding yourself figuratively steering to correct and or debating at various dead ends. This is from Curtis Christopher’s MassTranChron

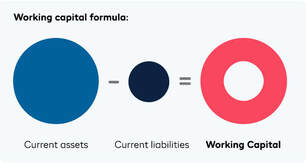

What is a WORKING CAPITAL LOAN? Working Capital Loans are loans that are taken out to finance the day-to-day operations of a business, rather than a financing option that is used to grow a business through acquisition or buy long-term assets. These loans cover short-term operational needs such as payroll, rent, and debt payments. Companies do not always have adequate cash on hand or asset liquidity to cover day-to-day operational expenses and thus, will secure a loan for this purpose. Companies that have high seasonality or cyclical sales usually rely on working capital loans to help with periods of reduced business activity. The immediate benefit of a working capital loan is that it's easy to obtain and lets business owners efficiently cover any gaps in working capital expenditures. The other noticeable benefit is that it is a form of debt financing and does not require an equity transaction, meaning that a business owner maintains full control of their company, even if the financing need is dire. Some working capital loans are unsecured. If this is the case, a company is not required to put down any collateral to secure the loan. However, only companies or business owners with a high credit rating are eligible for an unsecured loan. Businesses with little to no credit have to secularize the loan. A working capital loan that needs asset collateral can be a drawback to the loan process. However, there are other potential drawbacks to this type of working capital loan. Interest rates are high in order to compensate the lending institution for risk. Furthermore, working capital loans are often tied to a business owner's personal credit, and any missed payments or defaults will hurt his or her credit score. WORKING CAPITAL ADVANCES? A working capital advance, also known as a Merchant or Business Cash Advance, is not considered a loan. It is an advance of cash on your future credit card receivables, also referred to as a Revenue Generation Loan. For this reason, there is no APR rate and no set repayment terms. There is only a set payback amount. A flat fee will be charged to you for the advance. In most cases, these short-term working capital advances have a term of between three and twelve months. Why choose a WORKING CAPITAL ADVANCE? A working capital advance is ideal for a business owner who has had trouble obtaining funding from a traditional bank due to poor personal credit or lack of time in business. A working capital advance places less importance on these factors. However, they are deemed to be a high-risk advance and because of this the cost of capital will be higher. A working capital advance can be a great way to finance your holiday inventory, as chances are that you’ll need cash immediately, and working capital advances can get approved quickly. You don’t have to meet with a business manager and assemble all your business documents in triplicate—and you definitely don’t have to wait a month for the bank to get back to you about your approval. Repayments are made either daily or weekly via a business’ merchant processor or via a daily ACH debit from you company bank account. Working capital advances don’t affect your business credit limit, either. If an emergency happens, you can still turn to your credit cards or bank to find your way out of a struggle. These advances don’t cap your limit.  Why would you want a WORKING CAPITAL LOAN? A working capital loan can help when a company is in a squeeze and needs funding for short term goals. It costs less than a working capital advance, because more qualifications are required; a higher credit score, longer time in business and superior annual revenue. Such a loan also has more standard repayment plans and offers more flexibility compared to an advance. Working capital is the difference between your business’s current assets and liabilities. Assets may include accounts receivable, inventory, and cash on hand. Liabilities may include accounts payable and any payments on business debts due in the next 12 months. These short-term loans aren’t meant to solve all your problems. They are a stopgap to prevent the problem from getting any worse—and then allow you a pathway to working your way out of that debt. Social dynamics is a term derived from the idea of the change in the behavior of an individual due the influence of those around him in a group. An important factor or combination of skill, communication is a two-way process that enables you to exchange your thoughts, notions, and opinions with each other. It is very important to realize the dynamics of social behavior within your surroundings and or setting and improve the way you communicate with different people. A. Verbal Communication Verbal communication skills are required daily. The way you talk is an insight into your skills and your personality. When your words are confident, it leaves a great impression on the other person. The skill of clarity in speech, careful selection of words, voice modulations, responsiveness, and considering your audience will impact your communication personally as well as professionally. It is also necessary to be able to articulate your thoughts, the primary way you express an opinion within social settings. B. Interpersonal Communication Interpersonal communication is another type that is essential in today’s world. Getting the right balance of verbal and non-verbal communication is paramount, no matter which setting you're in. On a personal level, it is essential to build relationships with your family or the significant other. And in your professional life, interpersonal communication is necessary to showcase your skills as a good employee and a good leader. i.e. you are in a meeting where you stare at your watch frequently. This signals the counterpart that you are less (not) interested and have something more important elsewhere. C. Visual Communication When it comes to communication mediums, visual communication is the strongest medium in our current era. i.e. a strong logo is a great way for a brand to communicate with its followers or clients. A great example of visual communication are pop-ups while playing a game, showing the necessity of visual communication within a successful marketing strategy in regards to any business. D. Listening Apart from the three main modes of communication, listening is also an important way of communicating. i.e. in an interview, if a candidate does not hear the question properly, he/she won’t be able to answer it thoroughly or well. Hence, developing listening skills is an essential aspect of improving your communication skills. E. Formal/Informal Communication When we talk about formal communication, it has a great impact on any organization/business. Reports, e-mails, proposals, etc., are used for formal communication and creates a professional work ethic. Informal communication, on the other hand, allows people to put forward their concerns, discuss problems or solutions or bounce around creative ideas. Communication done informally considers the feeling of others and thus, is a vital part of all social situations. Communication is an inescapable part of life, whether it is in a formal or an informal setting, in an office or at home. Navigating social dynamics requires a range of communication skills and ideas expressed above, making note of the terms and concepts mentioned, will help you understand how to communicate more effectively.

Promoting "inclusiveness and diversity" within your organizational conduits constructs an open-minded, global organizational culture. Helping colleagues, clients, and customers around the world, better understand each other manifests an interesting and personally enriching environment for everyone. Diversity can take many forms, from culture and nationality to gender, race, sexuality, educational background, and more. Whatever your current role, here are five strategies you can implement right away to promote diversity in general.

1. Commit to boosting your own cultural competency 2. Actively seek out new perspectives and ideas 3. Treat others how they want to be treated 4. Observe diverse traditions, celebrations & holidays from other cultures 5. Contribute to the cultural diversity of your own groups & organizations |

AuthorsFeed contains original content, company and network updates from visiting authors & the contributing staff of the private equity firm, Sincere Headway Archives

May 2023

Categories |

||||||||||||||||||||||||||

RSS Feed

RSS Feed