Strategic Small Business Funding

We help companies succeed through acquire funding, working capital & merchant cash advances.

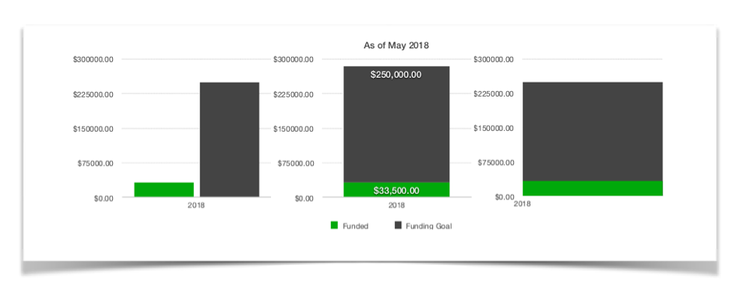

i.e. Example in the inception months adjacent (Before the the Will Call Entity, eventual brokerage was Established) #KineticCapital

Help You Find The Right Loan Type

How do I determine if I should apply for a Line of Credit?

Often times lenders are going to want to secure the loan with some type of personal collateral; a house, cash, stock, property, equipment or vehicles. Meeting this requirement is the first step in getting this type of loan. If there is sufficient demand for periodic operating expenses, this loan can be a good option as long as you have a good borrowing history and the income available for repayment.

Often times lenders are going to want to secure the loan with some type of personal collateral; a house, cash, stock, property, equipment or vehicles. Meeting this requirement is the first step in getting this type of loan. If there is sufficient demand for periodic operating expenses, this loan can be a good option as long as you have a good borrowing history and the income available for repayment.

How does Equipment financing work?

Whereas traditional loans require such things as a credit history and score that is respectable and documentation, equipment loans are not as concerned about those things since the equipment itself acts as collateral and secure the loan. In addition, there are very favorable tax incentives available for purchasing new equipment.

Whereas traditional loans require such things as a credit history and score that is respectable and documentation, equipment loans are not as concerned about those things since the equipment itself acts as collateral and secure the loan. In addition, there are very favorable tax incentives available for purchasing new equipment.

|

How do I determine if I should get an Inventory Loan?

This type of loan requires inventory as collateral, so one of the biggest requirements is having something to use for that purpose. Because there is often a need for ongoing capital, very often this can set up as a revolving line-of credit that allows for ongoing expenditures. |

Merchant Cash Advance

Often times, small businesses are beset upon by situations where there is a cash shortfall or urgent need for some type of cash advance. In some instances, there is no collateral and most of the business income is from credit or debit card sales. In other instances, there may be a lack of creditworthiness or some type of issue that prevents qualifying for a regular bank loan. |

There are a variety of different types of SBA loans.

The most popular is the 7(a) loan program, which is the primary loan, but, there is also a 504 Loan, Microlan loan and SBA Disaster loans. Each of these loans has specific criteria for qualification and loan cap. This can sometimes make it difficult to acquire one that meets your specific needs, so it is important to understand each before you apply. Here is a list of each:

7(a) Loan

Micolan Loan

SBA 504 Loan

SBA Disaster Loan

The most popular is the 7(a) loan program, which is the primary loan, but, there is also a 504 Loan, Microlan loan and SBA Disaster loans. Each of these loans has specific criteria for qualification and loan cap. This can sometimes make it difficult to acquire one that meets your specific needs, so it is important to understand each before you apply. Here is a list of each:

7(a) Loan

Micolan Loan

SBA 504 Loan

SBA Disaster Loan

|

|

Funding options to get a leg up on the competition, hire new employees, cover a down turn, purchase inventory, add additional revenue generating concepts, build a deck to add to your bar, purchase vehicles, or again... simply get that next project started. Start HERE

|

| pre-qualification_form_2020.pdf | |

| File Size: | 532 kb |

| File Type: | |