|

The Private Venture(s)

|

Sincere Headway

is home to the GestaltRoni Project & Fund What is the GestaltRoni Project? The project is a project designed to eradicate poverty and create permanent employment. Click HERE |

Find us on Social Media

|

|

|

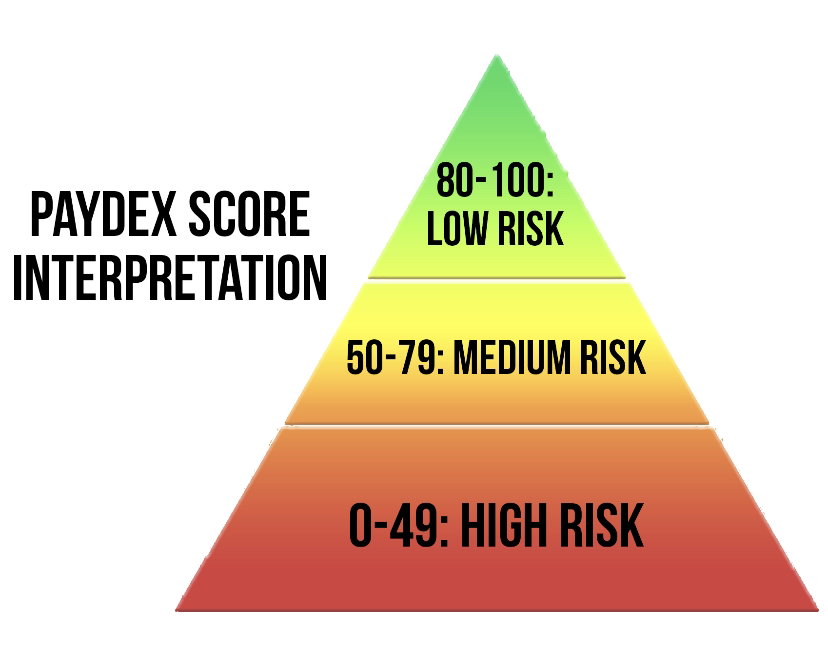

DO YOU HAVE A PAYDEX SCORE?

The exact definition from Dunn & Bradstreet, or D&B is: The D&B PAYDEX® Score is D&B’s unique dollar-weighted numerical indicator of how a firm paid its bills over the past year, based on trade experiences reported to D&B by various vendors.

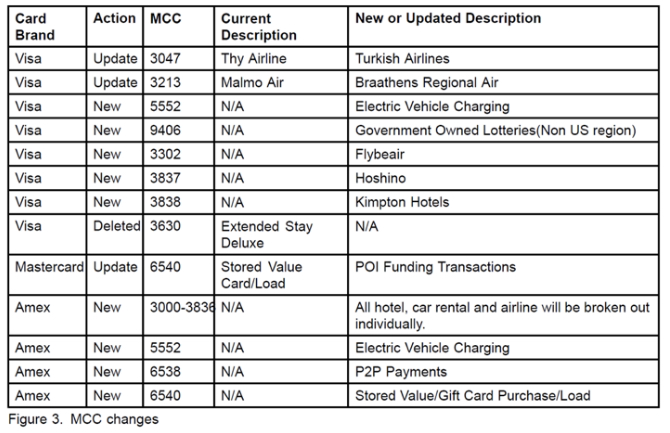

There are many BIG differences from a business Paydex credit score and an individual FICO credit score. Consumer FICO credit scores range from 350-850. The Paydex Score ranges from 0-100 with 100 being the highest score you can obtain. Having a Paydex business score of 80 or higher is very good, as scores below 70 are very bad. Individual credit scores are calculated based on a number of factors. The Paydex score is calculated based on only one single factor; whether a business makes prompt payments to its suppliers and creditors within the agreed upon terms of payment. For example, prompt payments will produce a Paydex score of 80. A 70 score reflects paying 15 days behind, 60 score is 22 days behind, a 30 score reflects paying 90 days behind, and a 20 Paydex reflects paying bills 120 days late. If you own a business, your Paydex score is essential in establishing new credit and continuing to build credit limits exceeding $100,000. Reference Pinnacle Business Service SC OCTOBER INTERCHANGE 2019 ANNOUNCEMENT Visa, MasterCard, American Express and Discover associations periodically review and modify their interchange rate structures and billing strategies. Specific association modifications are beyond the control of independent processors and will affect all merchant card processors and their customers. Visa, MasterCard, American Express, and Discover card associations have announced changes to their programs and rates effective October 2019. Visa, MasterCard, American Express and Discover are making several changes to interchange programs and rates effective for October 2019. Details of these changes will be available at a later date. Visa is updating their Global Private Label Specialized Fee Program. MasterCard is updating their Consumer and Commercial Product Codes for interregional and intraregional Refunds/Returns. MasterCard is updating certain interchange rates. MasterCard will be life cycling certain interchange categories from qualifying under IRD 62 and IRD 67 in the US Region. MasterCard is making changes to the following programs:

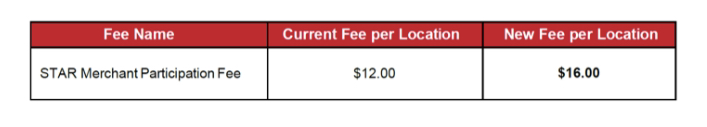

STAR is increasing the Merchant Location Participation Fee assessed annually from their current $12.00 Fee to $16.00. I In order to meet the required 30 day notification of increases and changes to merchants, the following statement message will appear on all August statements for some processors delivering to merchants early September. Effective October 2019: Visa, MasterCard, American Express, and Discover Card Services are introducing new (and modifying current) interchange structures and association processing program fees. Details surrounding these changes will be addressed on your September 2019 Merchant Statement. The Following will be included on active PIN debit merchant statements: Several PIN Debit Networks charge annual participation fees to access their processing networks. Effective in 2019, the ACCEL Network annual fee is $12.00, the PULSE Network annual fee is $12.00, the NYCE Network annual fee is $14.00, and recently announced, the STAR Network will increase its current fee from $12.00 to $16.00. Annual billing of these fees will occur as follows: the ACCEL Network fee will be billed annually starting in October 2019, the PULSE Network fee will be billed annually starting in April 2020, the NYCE Network fee will be billed annually starting in August 2020, and the STAR Network fee will be billed annually starting in October 2019. These annual fees will be collected from your merchant account for access to these PIN Debit Networks. Information is also by TSYS Find the right loan product HERE Loan Type Comparison: A Merchant Cash Advance, or MCA, is the agreement between a merchant and a lender to allow for smaller payments on an amount borrowed, rather than larger payments over a longer period of time. In this agreement, merchants essentially "sell" a percentage of their debit/credit card earnings to the lender. The lender is not a bank. Hence, they are not subjected to laws surrounding loans because the MCA is not technically a loan. Lenders can charge different interest rates than banks because of this.

A Term Loan is also a set amount loaned to a borrower, however, banks typically provide these loans. Unlike MCA's, these payments are not daily. Also unlike MCA's, the payments are a fixed amount on a fixed schedule. MCA's are different payments every day based daily revenue of a merchant. Term loans are usually fixed on a time period in various proximity to five years. Term loans are not based as much on financial assets like MCA's. Instead, the payments are often attained through the income produced by products that a business or merchant uses like machinery. MESSAGE FROM FASTERCAPITAL Considering the vacation season that came during the 3rd round of funding, FasterCapital would like to extend this round for more 10 days to enable startups that didn't submit yet to start their journey with our firm. So if you know any startup that didn't have the chance yet to apply to the incubation program, please ask them to apply: HERE. FasterCapital is ready to invest up to 2 million USD in each startup. If you also know incubators who might be interested in a partnership with FC, then we will appreciate if you can introduce them to us.

SHOP ELECTRIC & GAS ENERGY PLANS The states of New York, Ohio & Delaware require certifications to market as competitive supplier. Follow link to the website sign-up to reduce your expense and/or become a patron of our movement.

[Referral: Curtis Christopher W A7743350] https://bit.ly/2unFMEK |

AuthorsFeed contains original content, company and network updates from visiting authors & the contributing staff of the private equity firm, Sincere Headway Archives

May 2024

Categories |

RSS Feed

RSS Feed