|

The Private Venture(s)

|

Sincere Headway

is home to the GestaltRoni Project & Fund What is the GestaltRoni Project? The project is a project designed to eradicate poverty and create permanent employment. Click HERE |

Find us on Social Media

|

|

|

Social dynamics is a term derived from the idea of the change in the behavior of an individual due the influence of those around him in a group. An important factor or combination of skill, communication is a two-way process that enables you to exchange your thoughts, notions, and opinions with each other. It is very important to realize the dynamics of social behavior within your surroundings and or setting and improve the way you communicate with different people. A. Verbal Communication Verbal communication skills are required daily. The way you talk is an insight into your skills and your personality. When your words are confident, it leaves a great impression on the other person. The skill of clarity in speech, careful selection of words, voice modulations, responsiveness, and considering your audience will impact your communication personally as well as professionally. It is also necessary to be able to articulate your thoughts, the primary way you express an opinion within social settings. B. Interpersonal Communication Interpersonal communication is another type that is essential in today’s world. Getting the right balance of verbal and non-verbal communication is paramount, no matter which setting you're in. On a personal level, it is essential to build relationships with your family or the significant other. And in your professional life, interpersonal communication is necessary to showcase your skills as a good employee and a good leader. i.e. you are in a meeting where you stare at your watch frequently. This signals the counterpart that you are less (not) interested and have something more important elsewhere. C. Visual Communication When it comes to communication mediums, visual communication is the strongest medium in our current era. i.e. a strong logo is a great way for a brand to communicate with its followers or clients. A great example of visual communication are pop-ups while playing a game, showing the necessity of visual communication within a successful marketing strategy in regards to any business. D. Listening Apart from the three main modes of communication, listening is also an important way of communicating. i.e. in an interview, if a candidate does not hear the question properly, he/she won’t be able to answer it thoroughly or well. Hence, developing listening skills is an essential aspect of improving your communication skills. E. Formal/Informal Communication When we talk about formal communication, it has a great impact on any organization/business. Reports, e-mails, proposals, etc., are used for formal communication and creates a professional work ethic. Informal communication, on the other hand, allows people to put forward their concerns, discuss problems or solutions or bounce around creative ideas. Communication done informally considers the feeling of others and thus, is a vital part of all social situations. Communication is an inescapable part of life, whether it is in a formal or an informal setting, in an office or at home. Navigating social dynamics requires a range of communication skills and ideas expressed above, making note of the terms and concepts mentioned, will help you understand how to communicate more effectively.

Promoting "inclusiveness and diversity" within your organizational conduits constructs an open-minded, global organizational culture. Helping colleagues, clients, and customers around the world, better understand each other manifests an interesting and personally enriching environment for everyone. Diversity can take many forms, from culture and nationality to gender, race, sexuality, educational background, and more. Whatever your current role, here are five strategies you can implement right away to promote diversity in general.

1. Commit to boosting your own cultural competency 2. Actively seek out new perspectives and ideas 3. Treat others how they want to be treated 4. Observe diverse traditions, celebrations & holidays from other cultures 5. Contribute to the cultural diversity of your own groups & organizations

The First Fund is the, “GestaltRoni Project"

Designed for tentative release into operation, fourth quarter 2019-early 2020.

"THE GESTALTRONI PROJECT"

And so it begins, (4th Round is open!) share your dream with FasterCapital and begin working on fulfilling it. FasterCapital invests 50% of the money you want to raise (between USD 20k to USD 2 millions). Please apply and tell your friends.

RP: Curtis Christopher Wragg

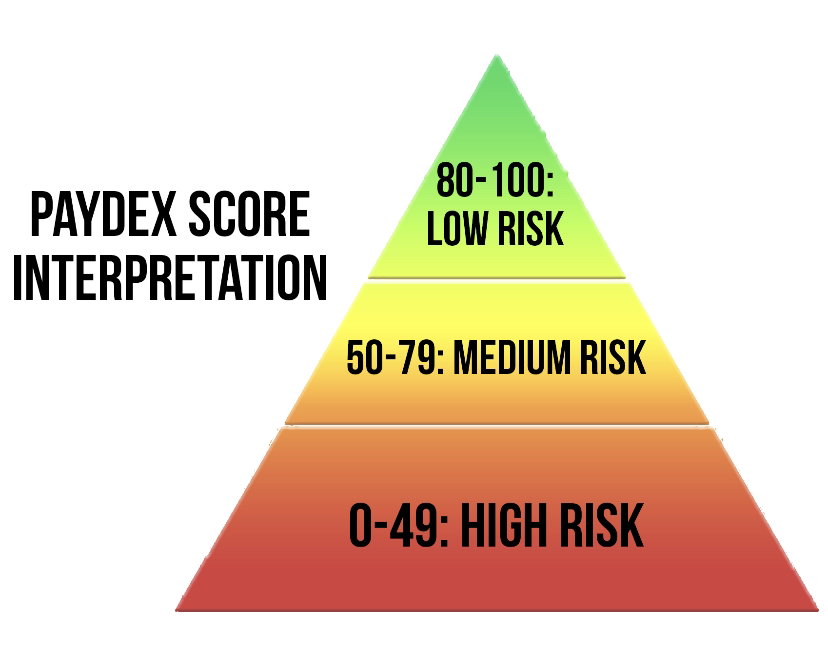

DO YOU HAVE A PAYDEX SCORE?

The exact definition from Dunn & Bradstreet, or D&B is: The D&B PAYDEX® Score is D&B’s unique dollar-weighted numerical indicator of how a firm paid its bills over the past year, based on trade experiences reported to D&B by various vendors.

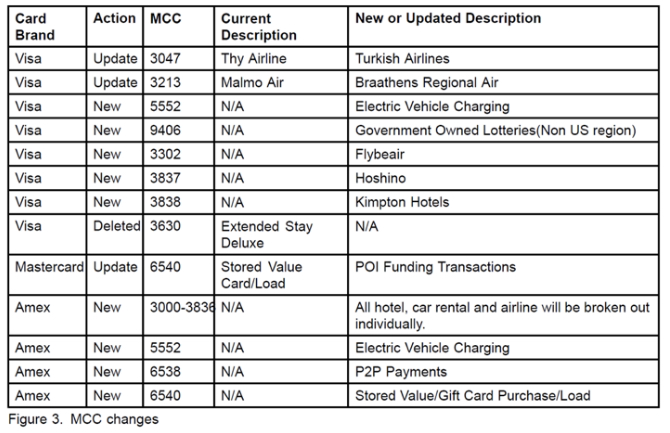

There are many BIG differences from a business Paydex credit score and an individual FICO credit score. Consumer FICO credit scores range from 350-850. The Paydex Score ranges from 0-100 with 100 being the highest score you can obtain. Having a Paydex business score of 80 or higher is very good, as scores below 70 are very bad. Individual credit scores are calculated based on a number of factors. The Paydex score is calculated based on only one single factor; whether a business makes prompt payments to its suppliers and creditors within the agreed upon terms of payment. For example, prompt payments will produce a Paydex score of 80. A 70 score reflects paying 15 days behind, 60 score is 22 days behind, a 30 score reflects paying 90 days behind, and a 20 Paydex reflects paying bills 120 days late. If you own a business, your Paydex score is essential in establishing new credit and continuing to build credit limits exceeding $100,000. Reference Pinnacle Business Service SC OCTOBER INTERCHANGE 2019 ANNOUNCEMENT Visa, MasterCard, American Express and Discover associations periodically review and modify their interchange rate structures and billing strategies. Specific association modifications are beyond the control of independent processors and will affect all merchant card processors and their customers. Visa, MasterCard, American Express, and Discover card associations have announced changes to their programs and rates effective October 2019. Visa, MasterCard, American Express and Discover are making several changes to interchange programs and rates effective for October 2019. Details of these changes will be available at a later date. Visa is updating their Global Private Label Specialized Fee Program. MasterCard is updating their Consumer and Commercial Product Codes for interregional and intraregional Refunds/Returns. MasterCard is updating certain interchange rates. MasterCard will be life cycling certain interchange categories from qualifying under IRD 62 and IRD 67 in the US Region. MasterCard is making changes to the following programs:

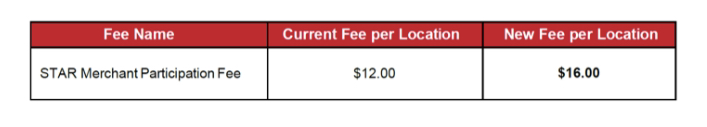

STAR is increasing the Merchant Location Participation Fee assessed annually from their current $12.00 Fee to $16.00. I In order to meet the required 30 day notification of increases and changes to merchants, the following statement message will appear on all August statements for some processors delivering to merchants early September. Effective October 2019: Visa, MasterCard, American Express, and Discover Card Services are introducing new (and modifying current) interchange structures and association processing program fees. Details surrounding these changes will be addressed on your September 2019 Merchant Statement. The Following will be included on active PIN debit merchant statements: Several PIN Debit Networks charge annual participation fees to access their processing networks. Effective in 2019, the ACCEL Network annual fee is $12.00, the PULSE Network annual fee is $12.00, the NYCE Network annual fee is $14.00, and recently announced, the STAR Network will increase its current fee from $12.00 to $16.00. Annual billing of these fees will occur as follows: the ACCEL Network fee will be billed annually starting in October 2019, the PULSE Network fee will be billed annually starting in April 2020, the NYCE Network fee will be billed annually starting in August 2020, and the STAR Network fee will be billed annually starting in October 2019. These annual fees will be collected from your merchant account for access to these PIN Debit Networks. Information is also by TSYS Find the right loan product HERE Loan Type Comparison: A Merchant Cash Advance, or MCA, is the agreement between a merchant and a lender to allow for smaller payments on an amount borrowed, rather than larger payments over a longer period of time. In this agreement, merchants essentially "sell" a percentage of their debit/credit card earnings to the lender. The lender is not a bank. Hence, they are not subjected to laws surrounding loans because the MCA is not technically a loan. Lenders can charge different interest rates than banks because of this.

A Term Loan is also a set amount loaned to a borrower, however, banks typically provide these loans. Unlike MCA's, these payments are not daily. Also unlike MCA's, the payments are a fixed amount on a fixed schedule. MCA's are different payments every day based daily revenue of a merchant. Term loans are usually fixed on a time period in various proximity to five years. Term loans are not based as much on financial assets like MCA's. Instead, the payments are often attained through the income produced by products that a business or merchant uses like machinery. MESSAGE FROM FASTERCAPITAL Considering the vacation season that came during the 3rd round of funding, FasterCapital would like to extend this round for more 10 days to enable startups that didn't submit yet to start their journey with our firm. So if you know any startup that didn't have the chance yet to apply to the incubation program, please ask them to apply: HERE. FasterCapital is ready to invest up to 2 million USD in each startup. If you also know incubators who might be interested in a partnership with FC, then we will appreciate if you can introduce them to us.

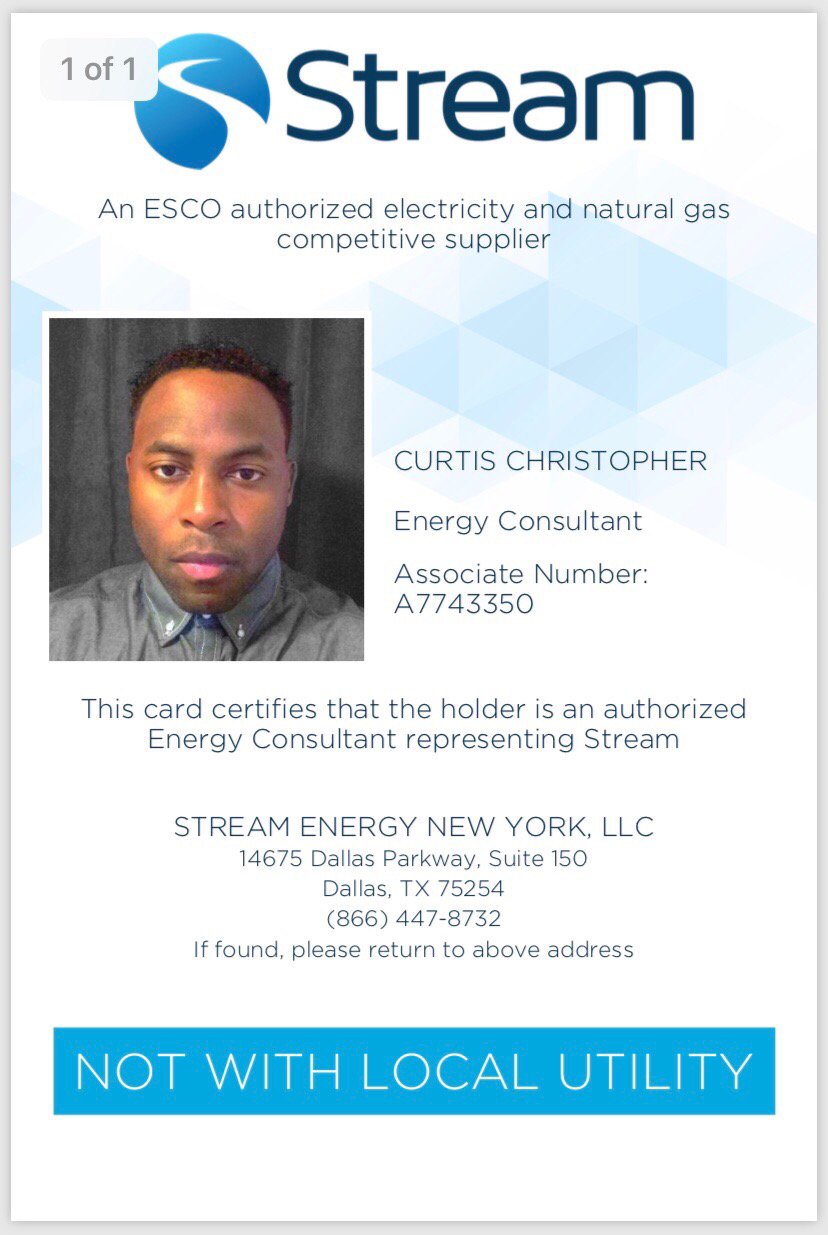

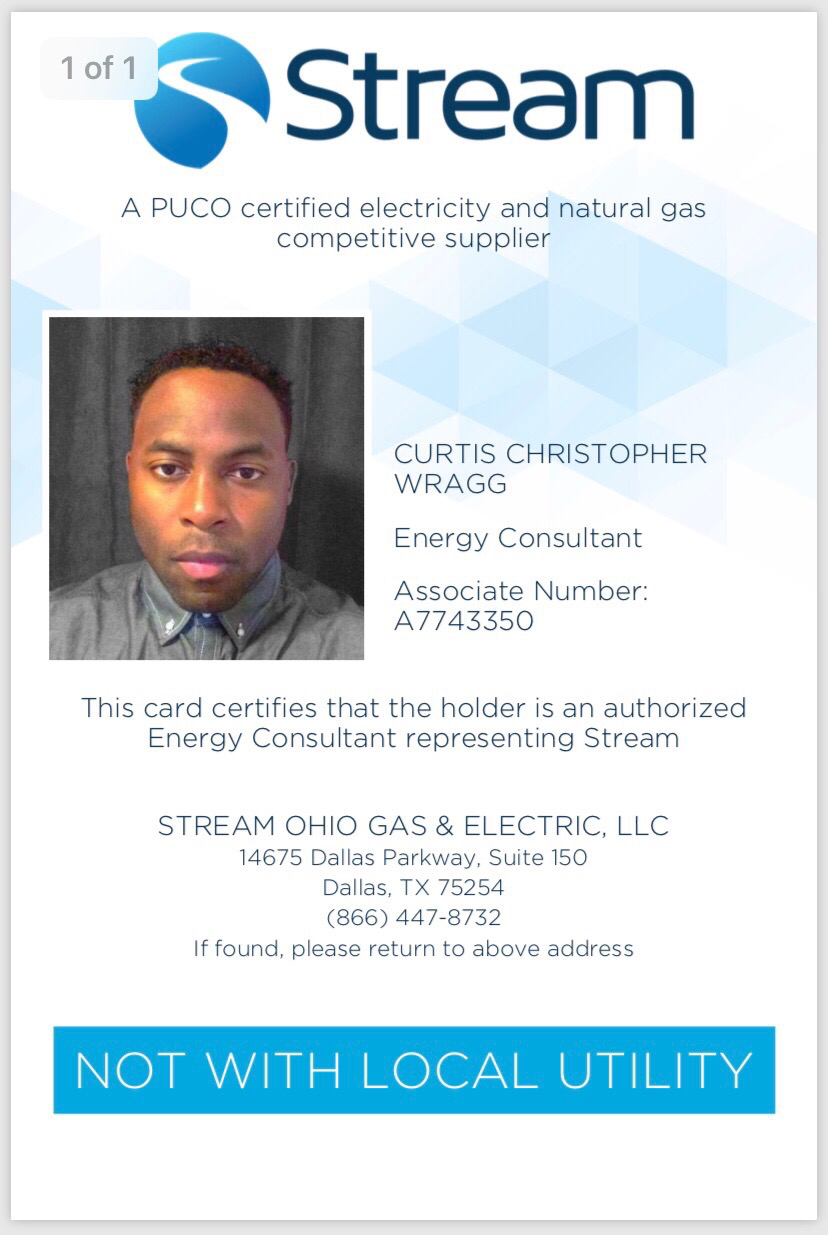

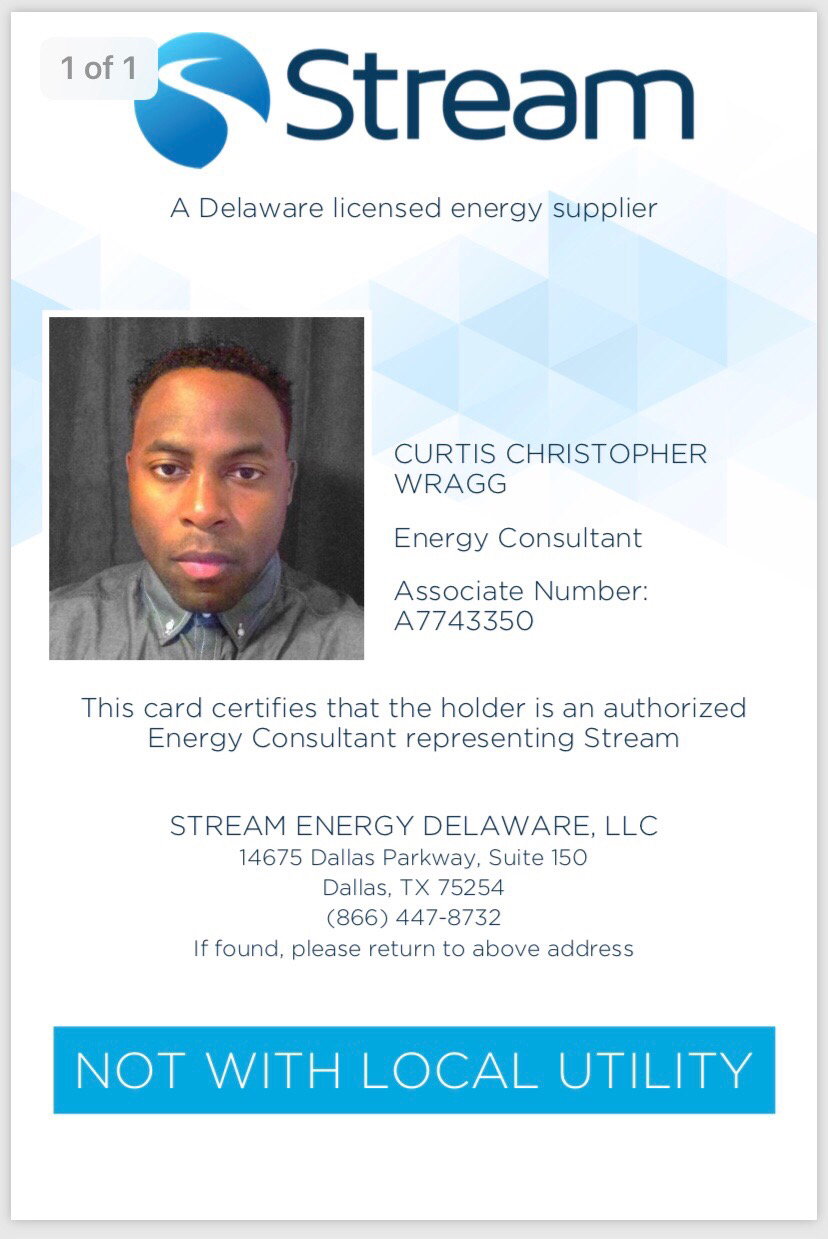

SHOP ELECTRIC & GAS ENERGY PLANS The states of New York, Ohio & Delaware require certifications to market as competitive supplier. Follow link to the website sign-up to reduce your expense and/or become a patron of our movement.

[Referral: Curtis Christopher W A7743350] https://bit.ly/2unFMEK Mergers & Acquisitions

In the arena of business finance, mergers and acquisitions involve the management and strategy of purchasing or joining with other companies. Acquisition is one company taken over by another, and mergers are the combination of two companies to form one. Both are used to expand a company's reach by creating shareholder value or gaining market shares. Contact Bovell Financial today and find out if your investments can be combined to create a more efficient business model through mergers and acquisitions. What's the Difference Between Mergers & Acquisitions? Although the term “mergers and acquisitions” is often used to describe various restructuring strategies, the two words refer to different business activities. Acquisitions occur when one company purchases another, eliminating them as an independent entity. In certain situations, these activities can appear hostile, so they are called mergers to get rid of any negative connotations. A true merger is when two equal companies decide to join resources and interests and form a single entity under one corporate name. Bovell Financial provides support services for merger and acquisition transactions including: • Evaluating and addressing finance issues • Risk management • Business valuations • Due diligence for operations, cash flow management, and accounting • Transaction structuring for profitability and competitiveness • Post-transaction activities Types of Mergers Mergers can be structured in different ways, depending on the relationship between the companies involved. Horizontal Merger: Both companies involved in the merger are based in the same industry and sell similar products or services. They may be competitors, so the idea is to alter this balance so together they increase the market share and avoid challenging each other. Vertical Merger: The companies are still in the same industry, but their products or services occupy different stages in the supply chain. As they merge, they capture more of the market, cut cost and inefficiencies, and keep the supply flow steady. Concentric Mergers: This is between two companies in different industries and designed to improve each company's effectiveness in different areas and markets. Market-Extension Merger: Usually occurs between two companies that offer the same products or services but in different markets. By combining resources, they grow their base and target market. Product-Extension Merger: The companies sell related products or services in the same market and can gain access to more consumers by grouping their offerings. They use similar supply chains, and processes, and their products complement each other. Benefits of Mergers & Acquisitions The main benefits of most restructuring actions is an increase in cost efficiency, value generation, and market shares. As companies integrate to form bigger organizations, the output of productions rises and increases the opportunity for lowering the cost per unit in production, creating value that helps sell products and services to customers. With better cost efficiency, the company becomes more competitive, driving up market shares. Higher stock prices ensure that the company will have the investment capital they need to fund future operations. If you are searching for a technical cofounder and an investor then search no more! FasterCapital's will become your technical cofounder and will invest 50% of the capital needed. FasterCapital's 3rd round of funding is open from 15th of Jul to 15th of Sep. This round is dedicated to non-technical entrepreneurs who are seeking money and a technical co-founder. For those who are interested please submit your startup on HERE to be included in the incubation program. If you want more information then please check the information on HERE and we are ready to answer any question you have. Please note that Curtis Christopher Wragg is our USA Regional Partner, note and be advised during the application and adjacent processes.

Karatbars International is an e-commerce company that sells Gold to the masses in gram sizes. There are no start up costs and is Free to register for your Gold Savings Account. No Credit Card is required and you are not asked your SSN nor to my knowledge is it a MLM - nor are there any monthly fees.

There are packages available to increase your commission options if you so choose to use them. At the Free Unilevel, you still get paid for sharing this amazing opportunity with others. The money you put into this business goes right back to you. You purchase Gold (greater value than paper currency) and you'll get free Gold as well. Karatbars GOLD is 999.9 Fine 24K. This is one of the most exciting opportunities we've ever seen out there. It's a Win Sum Opportunity. The Story of Sincere Headway By Anonymous In 2012 after returning to his home in Mason, Ohio and while frequenting up and down the famous Western Row—in and out of town, the founding business executive and owner, Curtis Christopher Wragg was able to create and increase his voice to constituents through social media on modern platforms like Instagram and Twitter—the name gained global attention. The Origin The original manifest or name was created and used ironically on Myspace, a networking social media site. The name “Sincere Headway” was created yet replaced Curtis Christopher’s previous name, with origin that dates back into college, “Prince Propaganda” also known as “Propa” for short. Like it has always been on social media, just a group of friends and a select ambitious few, networking and working toward having a good time. However Propa, the name for short, also had some musical escapades. Featured at the time on a couple young producers’ works—some in humor and others in the nature of its worldly craft—to entertain, inform and or effect change. From Myspace, Curtis Christopher used the name Sincere Headway on other social media outlets like BlackPlanet, where he managed relationships perpetually until our current and modern phase of social media took over. The Current Basically just another guy on a networking website, being entertained and or entertaining. However Curtis Christopher was inspired by images of success on the sites, as well as those in which he gained exposure during current events and self education. He visited Chicago and signed on to work as a traveling business analyst in 2013 for an international consulting firm, where he met several business and executive level counterparts. However there was one gentlemen in which Curtis Christopher developed a scrappy relationship with. Post assignments and after retiring to fall back into what Curtis hoped to be another career, he and Greg had a string of conversations that seemed to develop the next business concept. According to Curtis Christopher, Gregory Coopwood was “a government grand master in Six Sigma” (not aware of Greg’s official title). But after a debate filled yet energizing conversation that stretched into the late evening about several topics including the altering of Greg’s business plan to partner and make a modest $3 million per month, the two ended the phone call that evening and never spoke again. The ex-college football player, family and business man passed away in the following days and sent Curtis Christopher into a light depression in which he began shopping the corporate world for attractive roles to reignited his career. The Currents When you begin to wonder what or that that is in a name, I was advised by Curtis to dream adjacent to him while referencing names such as Berkshire Hathaway—former Textile company prior to Mr. Warren Buffet’s current design. Morgan Stanley—an American bank and investment advisory firm and numerous others. As you might also, I find similar names very interesting. In 2016 at a time where Curtis Christopher was experiencing questionable finances, he was reintroduced to merchant services or credit card processing, something he had tried briefly and had some success with early in and adjacent to his corporate career. However in 2016 he took the backing of a reputable payment processor to the streets to better his financial situation. “It was initially torcher, running people down and trying to show the value in a sale with a high law of average.” He referenced a business relationship who once expressed to him in a Miami Florida office building, “I had one foot in a nice home and the other foot in the homeless streets. But I would have killed myself before I would have gone door to door selling credit card processing.” Curtis said he chose not to debate with him, accordingly Curtis informed me the guy was captivating and said he totally understood whole-heartedly what the guy was saying. “His story was filled with such similarities to mine that I was taken by the irony and energized by his story as well as his operation in which I worked within that was successful.” When asked how much credit card processing did he sell back during the 2016 time of questionable finances, he to avoid dodging my question and or making excuses, said “not enough.” However after dodging and parading in and out of the juvenile court system as he described the time of questionable finances as “fighting a women that mothered my child, who later ran off with my child on multiple occasions at opportunistic times and who is actually considered absent from my life (including child) completely to this day.” Curtis seemed to gather himself, “I was summoned time and time again to address some times the same things and on other occasions new matters that seemed to only benefit the county we were in and the mother of my child or in some instances her lawyer.” Curtis Christopher had not incorporated, so as he became a larger presence as a business man in the communities he grew up in and or the city he actually cut his teeth in during his days as a management trainee for what is now a Fortune 500 Corporation, he said it seemed his presence was requested and desired downtown in the family or child support courts by those that it behooved to summon him more than he cares to address or remember. When asked why so much and why so long, Curtis replied, “sometimes it was about money, I actually humbled myself to request a reduction because as outlined in black and white as a level of service or an exception to grant such a reduction, my income was reduced by more than 33 percent—however my request resulted in an increase in my obligation and after several attempts to fight or appeal, the excess grew into a problem that was only addressed as a payment issue after I found time to spend half of my day in the office of a lawyer and in the presences of the administrators and clerks. I wasn’t making what I call ‘for-sure money’ as a start-up or new business I was in a unjustified hole in which my attempts were denied 3 times consecutively and finally honored when filed during another proceeding in which it only became leverage to dismiss the entire docket of semantic ‘bs’ I had been fighting for the previous year because the other party, my child’s mother, did not respond to the certified mailings—however her lawyer was in attendance to court at each and every proceeding.” Curtis expressed “I lost all respect for the family court system and the governing bodies. I was and had been the guy they’d ask to take a step back and think of others my entire life. I directly informed the courts that I saw it to be a simple matter in which I had faith they could address and send our parties away in a timely yet cognitive and comprehensive manner—nothing of the sort happened, it was my exposure to gluttony and any ‘ism' you wish to make a case for.” Curtis Christopher has a lawyer who represented him for the first half of the ordeal but became a none factor—dismantled during the proceedings in Curtis Christopher’s presence by the magistrate and what seemed to be the other party. All which lead to inter-party conflict during court and ultimately a verbal altercation about the proceeding and ‘best interest’ outside of court between Curtis and the attorney. He continued to say, “my court appearances were also about my time with my child—there was over a year long proceeding that involved custody, child support and the details surrounding connected topics.” “At that time I was just a sole proprietor, working on my social security number, or 1099s trying to leverage the platforms of those who had had success before me and actually trying to avoid negative attention that seemed to gravitate to me in the only form in which a person like me would be venerable at the time—my child. To address lifestyle, I lived in a nationally recognized community and had lived there for an extended period of time, actually right under 10 years in total (he mumbled best ranked schools in Ohio). The purchase of the home was actually during a negotiation time frame surrounding the relationship with my child’s mother and was actually occupied by the 3 of us for the initial 6 months.” It was after the process that lasted over 1 year in the family courts was over and dismissed including his attempts to reduce his payment obligation on April 5th 2016, that Curtis Christopher made the decision on April 21st 2016 to take $200 of his last $700 available capital at the volatile time, to incorporate what now is Sincere Headway Incorporated (Inc) to begin separating his turbulent life from his focus and his developing business relationships at the time. Curtis Christopher Wragg do live on+ Find me on the professional sites like: Linkedin My father worked in management onsite for over 30 years for Seagrams which became Pernod Ricard. At home he had a desk down stairs in the basement, however to my mother's dismay, he liked to use the dining room table to write on, as to pay bills scribe letters, etc. Now—not much to complain about right? However if you’ve heard me speak at length of my father in the past, he was a manly man. Accordingly he was very heavy handed; his print and signature was the largest, if not, the only reason mom’s dining room table developed a slight wobble over the years. Lol, my dad had a very heavy hand—honestly as he would press down and make unique markings. Funny how my hands are light to the touch, I’m a finesse(er). I envied during by athletic years the guys with the heavy arms who could throw effortlessly—as heavy as my arms and hands are they are not so much as it seems to me. Ironically my father was cat like, for instance how he would walk, ninja like, around the house. Nevertheless, I heard many stories about his job and asked countless questions in which I received answers about the spirits and liquor industry and email responses or dialogues. I’d lay on the floor in the dining room and rummage through his stacks of emails and printed documents that he kept in a pile in boxes beside our China Cabinet. Honestly with respect for his career, I was most proud of my dad when he retired and was ask to return to consult in Indiana. Not the New York City stock broker, but "pockets full of fast money, but his clothes said slow bucks" as he wore chinos and casual steel toe shoes, polos and sweater vest. A choice he made for an extended period of time, however I say this to you and I say to all, do not be so quick to leave work—you might find out that there is not much to you or potentially life without it. Kids—get involved in their lives immediately. S/o to Snoop Dogg, my dad really enjoyed you, "Ole Snoop and the song got sales rolling Curt."

Best of Luck

Letter notes from CCW today: Today I made some phone calls in effort to drum up business. Note I’m in a small office in the town I was raised, making calls to the surrounding population—“I’m Curtis with Kinetic Capital, we outfit businesses with working capital...” a total cold call. The business owner on the other end replied, “is it hard money?” And recently I’ve spent the last few months researching and debating with global brokers about “soft loans” so I immediately said, “yes—“ and went on to explain the process and was tastefully interrupted. ”No thank you I don’t want any hard money.” Soft money or better soft loans are typically lent with the notion that the money will benefit an underserved population—humanitarian in some instances. Nevertheless, for profit as well as nonprofit in many cases. Soft loans regardless, are lent with a desire in mind that includes a return on the money per the terms of it—case by case. The phones, as I call it, are special—you have to get into a groove. Accordingly the reality is at Kinetic Capital—you provide your desire in the form of our one page application; the amount requested, any liens—yes? “Well we can only work with you if you’ve been placed on a payment plan, ok your on a payment plan great—stuff happens, I get it” etc. Then most importantly, how do you plan to use the money? To improve Cash flow? Equipment? Start a project? Hiring? What? The dynamics of the loan or the capital funder are predicated in their ability or our ability to meet your need with a program or product that works for us both i.e. equipment is collateral in its self per se and adjacent, if your statements reflect that you have the revenue coming in to support a bridge style loan, then bank statements in that instance is your key to unlock a door to funding that is proportionate. Sincere Headway Inc. All Rights Reserved.

Liken to our stock exchange, businesses have a range that begins with the launch and extends into future earnings—value is a range. Business Valuation — Profit (1) Assets minus Liabilities = Equity and/or Enterprise Value of Operation $650,000 minus ($835,000) = ($185,000) ← negative, meaning extra liabilities (2) On the other hand look at earnings: Revenue $143,000 x 3 $429,000 (3) $429,000 ← Part 2 “Earnings” -$185,000 ← Extra “Liabilities” (excess negative) $244,000 ← Valuation Tangible Net Worth of your Enterprise ≈ $250,000.00 (+ range +) the Future. Sincere Headway, Inc. All Rights Reserved.

LinkedIn released an article back around May 2016

Find Curtis-Christopher Wragg ⟺ on Linkedin

LinkedIn released an article back around May 2016 about digital disruption and how it has revolutionized the sales and marketing landscape.

“In the traditional model, marketing tells a targeted group what to want. Then sales tells them why they want it and takes the order—this model is less effective now that buyers are more active in information gathering. They know what they want and why. When today’s buyers have questions, they search for answers online instead of relying on information from a salesperson. Sales and marketing must align themselves to a new shared set of goals to reach buyers.” In the writing, LinkedIn did a great job preparing people for the social selling revolution of the past few years—mantra, “get started with social selling on LinkedIn,” brilliant. Now their mentioned periodical, executed the objective in five short, yet purposeful chapters.

The read is 10-15 minutes and for you track stars that cover ground fast and well, its 30 pages—time yourselves.

Bare no expense, I’ve drawn a conclusion—Dear Homosapien, listen, what you believe will happen, is what will happen. Acknowledging your banking institution or favorite businesses which provide you with promotional or (free) branded pens or writing utensils—draw your own conclusion, especially if your in a position to influence the future of AI developments and advancements. And from a mental health stand point, surround yourself with the humans that make you feel good and/or who add value to your life.

Jack Ma expresses that we have to invest in technology, however he does not like the technology debate—centrally because of his mention of artificial intelligence and big data. Surely perception is reality, accordingly, illustrated in media entities such as TEDx Talks and even interviews with Elon Musk, the billionaire entrepreneur in Inc. Video (Published Oct. 30, 2017 Magazine), Elon expressed that the future of AI is going to be pretty scary. Jack from another angle says yes, AI will threaten human beings. He expresses the desire for AI to support human beings—it should always do something to enable human beings, not disable people. Nevertheless Jack Ma has a message for the arrogant cashier at your local bodega, he says “you will never be able to compete with AI.” He feels that AL offers humanity an amazing but risky opportunity, “the AI robots are going to kill a lot of jobs.” “People need to develop soft skills to compete with artificial intelligence,” Jack focuses he’s greatest concern in the service industry. Furthermore he says, a computer is always going to be smart data (smarter than you). It never forgets, it remembers everything.

“Forget about running faster than a car.”

“Where there’s a plane, don’t think you can fly like a plane.” —Jack Ma

Elon Musk notes that AI is rapidly advancing, too rapidly according to Elon. With both hands open wide, he has repeatedly sounded out about the dangers, according to his perception and research.

In a 2017 interview—AI might someday become too good at its job. Something created to specialize at one thing might destroy many if not all things in its reach or path, including humans. Beyond creative destruction, referencing audio tapes and cds, Musk is referring to the pot that boils over per se, catches fire and cremates the decor of a lovely kitchen and all the inhabitants at the time of raid. He acknowledged a former Uber engineer who wanted to create an AI based religion. Ever heard of an AI ‘god’? The engineer’s name is Anthony Levandowski, the founder of a new AI-based religion called Way of the Future. His creation is focused on a high-tech ‘deity’ as a way to improve society. In 2015 Google outlined plans to create a kill switch that would disable AI. Musk thought those efforts were futile. “I’m not sure I’d like to be the one holding the kill switch,"he said.“ Because you’d be the first thing it kills.” Thus the race for AI superiority, will raise tension between powerful countries. The competition, he said is a likely cause of World War 3. In 2017, a computer beat the world’s best humans at a video game that involves military strategy. Musk tweeted, “If your not concerned about AI safety, you should be.” The Eye Short Writing Series By Curtis-Christopher Wragg Twitter @ccwraggii “It’s basic human nature to focus on immediate, “in-your face” problems, and the average contractor sure gets lots of practice. Most are very good at crisis management and making important technical and project-management decisions on the spot – it just comes with the territory. The problem is that far too many owners spend years doing nothing but putting out fires and keeping projects on track, while ignoring issues related to the firm’s long-term viability. The result is a business that’s dangerously out of balance.”

— As Featured in Construction Today Word to the adjective grammatically related to the term, ‘long-term viability’. Retirement and succession planning are two good examples. Nevertheless, it seems the only way to offset the chore of fighting fires is to expand and delegate the task to an employee. Honestly, growth is paramount. Of course creating an index to measure the matrix of task and services is nothing new. It was a genius idea, over a decade ago—nevertheless, it too, requires the expansion of your force. Let’s think, what could you do? Randomly call your customers and have them rate your service? Umm, that would produce qualitative as well as quantitative data to serve as the basis for recognition as well as a handy tool to minimize potential fires. Could you pull that off? Nah, let’s move on. In good and bad times note, that healthy individuals recover more quickly from illness, so, too, do healthy businesses recover from a few bumps in the road, such as an economic downturn. Among the retrospective measures that reflect a company’s health are items on the balance sheet and income statement, including cash flow, net profit, growth rate, productivity and return on investment rates. Unfortunately, by the time such historical data indicate symptoms of trouble, it may already be too late to reverse the condition. What owners really need is real-time information that lets them exert control and steer the company, according to a business plan, toward a predetermined profit. Owners who only look at historical numbers may be in the eye of a hurricane, unaware that it is tearing the business apart around them. Consequently, many times the larger, wealthier enterprises win (didn’t say do the best jobs on projects). “More than 400 construction company owners and various contractors were surveyed and were asked, ‘What business are you in?’ Only one business owner answered the question correctly. The wrong answers went like this: ‘I’m in the construction business.’ The right answer came from a plumbing contractor who said, ‘I’m in the sales business, and I just happen to be really good at plumbing installation, service and project management.’ That plumbing contractor is doing very well at a time when many other construction-related businesses are failing or stagnating and are blaming the economy.“ This passage is part of an article developing the idea of what I like to call a ‘Paradigm Shift’ featured in Construction Today. The idea is predicated by thoughts that, “an owner’s mentality can drive company culture to either inhibit or stimulate innovation.” Ultimately—please run and tell this, the dynamics of your desire to grow the business in revenue or profit is either in a irrefutable fashion, innocence or even laziness, the chief goal. Your title or owner’s mentality will direct a company culture to either drive sales or to cut cost—and my friends, those beaten down, shaken and stirred are the only options. Accordingly if you desire something to hug per se, hug this— “I cannot help the poor if I’m one of them, so I got rich and gave back,” expressed by Mr. Sean Carter. “To me, that is the win-win (win-sum game).” Accordingly never ignore that dynamic or Milton Friedman’s 1970 New York Times article, The Social Responsibility of Business is to Increase its Profits. Apparently even titles within many business entities have created limits on businessmen, individual proprietors and corporate executives abilities to execute the things needed most and have altered mentalities over the years—as we are acknowledging right now. It is currently a popular blueprint to talk of or promote “desirable social ends; the business has a social conscience.” In fact, corporations or large enough enterprises actually do and believe it or not, hire personnel to eliminate discrimination, environmental issues and size up social responsibility. Large enough businesses enjoy social responsibility beyond social emotions and reduce tax obligations as a direct result of philanthropic and community involvement. Nevertheless, “in fact they are—or would be if they or anyone else took them seriously-preaching pure and unadulterated socialism. Businessmen who talk this way are unwitting puppets of the intellectual forces that have been undermining the basis of a free society.” Back to the original situation at hand, you can generate sales and/or you can cut cost--folks those are your options. The blame for failures can be directed toward drivers in the economy, competitors or banks, but all business can be reduced to an extended metaphor--leaky bucket. All business entities are buckets that have the potential to leak, in which we generate sales in the form of adding water and we loose equity, value or accounts via the dynamic we call, “leaking.” Lost business varies from operation to operation and may also be addressed by what we call a reduction in foot traffic in environments such as retail. Nevertheless, in some businesses the sale begins and in others, the sale ends the service, production or labor portion of the business at that time—process begins again via marketing and promotion simultaneously (enjoy that tangent). Construction Today expressed, “only a radical change in mindset can save the business. Decide not to let the economy, the banks or other external factors kill the company without a fight. Then, be in the selling business.” Yes, I have to remind myself, “wake up,” the company culture is the catalyst or the boat hovering on a worldly conduit that has the ability to manifest a self-filling prophecy. Recall Mr. Plumber? “I’m in the sales business, and I just happen to be really good at plumbing installation, service and project management.” All—be in the selling business. |

AuthorsFeed contains original content, company and network updates from visiting authors & the contributing staff of the private equity firm, Sincere Headway Archives

May 2024

Categories |

RSS Feed

RSS Feed